Crypto Bank. Possibilities.

- Banks. Current Problems.

- Blockchain: Remedy or Poison?

- Possible options for clients.

- New technologies for financial crypto transactions.

- Crypto bank. Pluses and Minuses.

Banks. Current problems.

Banks — financial organizations which aggregate money from people and earn by using the money in their non-transparent and dubious deals for only own financial enrichment. And now, lets go into the details of how it works in reality.

Work of banks, from opening to full-scale financial organizations can be split into three stages, «Classification», «Allocation» and «Enrichment».

Stage 1 («Classification»):

The main bank task at the stage 1 is to classify people, potential clients, on the basis of money quantity people have. What do they need this for? Everything is pretty simple! The banks try to please every potential client designing a special proposal for each of them. The quantity of proposed options and bonuses is directly dependent on quantity of client’s money.

In other words, if you aren’t a VIP-client with, say, one million dollars on your deposit account, so, then, first, you are going to spend a lot of time for a bank office service, second, your phone call waiting will take a long time, third, your as insurance as deposit percents will be minimum, fourth, a chance on buying, say, real estate will be also minimum and, finally, fifth, percents of your bank credit, if you were lucky to get it, will be enormous.

Stage 2 («Allocation»):

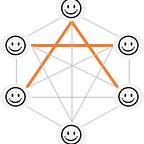

The main bank task at the stage 2 is to allocate option resources between the clients such that the own bank wallet will be full in a perspective short-time future. It is obvious that the banks will always opt for reach people, «Minority», presenting them a kind of gold bank options about which «Majority» have even never heard. But, what is more important, closedness and opacity of the banks towards «Majority» will always take place in current bank system.

Stage 3 («Enrichment»):

The main bank task at the stage 3 is to maximally increase its own capital through attraction of a new mass of «Majority» clients. In other words, by means of drastic growth of «Majority» clients, the banks will be capable of opening new option lines for their VIP-clients. Moreover, with the growth of «Majority» clients, the banks are used to increase wall thickness, degree of opacity, that is committed to protect them against any «Majority» intervention.

So, what do we have now for people who are compelled to apply to the banks for financial service?

«ACCESSIBILITY» — «Tell the banks how much money do you have and they will tell you back what you may get. If at all anything, of course, there is for you».

«TRANSPARENCY» — «Transparency will never go out of border of client’s account».

«RELIABILITY» — «Reliability or options are exclusively determined by the size of client’s wallet».

«OPPORTUNITY TO EARN MONEY» — «Possibility for «Majority» to earn money is limited by minimum deposit percent which is unlikely enough to cover inflation rate».

«CLIENT”S FINANCIAL SUPPORT» — «In case of a delay of monthly payment, with no doubt, the banks will forcedly evict you and your family on the street».

«STORAGE OF CLIENT’S PERSONAL DATA» — «Officially, so far, there is no any documentary evidence that any of the banks will guarantee a safety of client’s personal information. The guarantee that will protect the client’s personal information from third party intervention».

«POSSIBILITY OF RESTORATION OF CLIENT’S CREDIT HISTORY» — «In case of even a single payment expiration there is no guarantee that your credit history will be cleaned soon. Moreover, even if all percents and credit money were fully paid the banks are used to enter your personal data in a black list for indefinite period of time.

In order to solve above-mentioned problems, obviously, we need a cardinally new approach in servicing clients. The new approach that will be primarily focused on client’s welfare and his/her financial protection.

The main goal of this article and subsequent ones as well is to explain one of new possible technologies that will give «Majority» much more stability and security in financial field and, what is more important «independence» from a third suspicious party.

To be continued …